2 minute read

KEY TAKEAWAYS

- Maximise your return by claiming all eligible business expenses like rent, lash supplies, marketing, and training.

- Keep thorough records and consider using a separate business bank account for easier tracking.

- If working from home, claim only the portion of household costs used for business.

- EOFY is a smart time to invest in deductible upgrades, boost your setup and reduce taxable income.

As the end of the financial year (EOFY) in Australia draws near, it’s a great time for you, as a small business owner, to brush up on your tax knowledge. Here’s an easy-to-follow guide to help you make the most of this tax season.

1. Know What You Can Claim

Start by understanding that purchases directly related to your lash services are deductible. This includes:

Overhead Expenses: Rent, electricity, and water bills, which are essential for maintaining your business operations.

Lash Supplies and Tools: Adhesives, lashes, tweezers, etc.

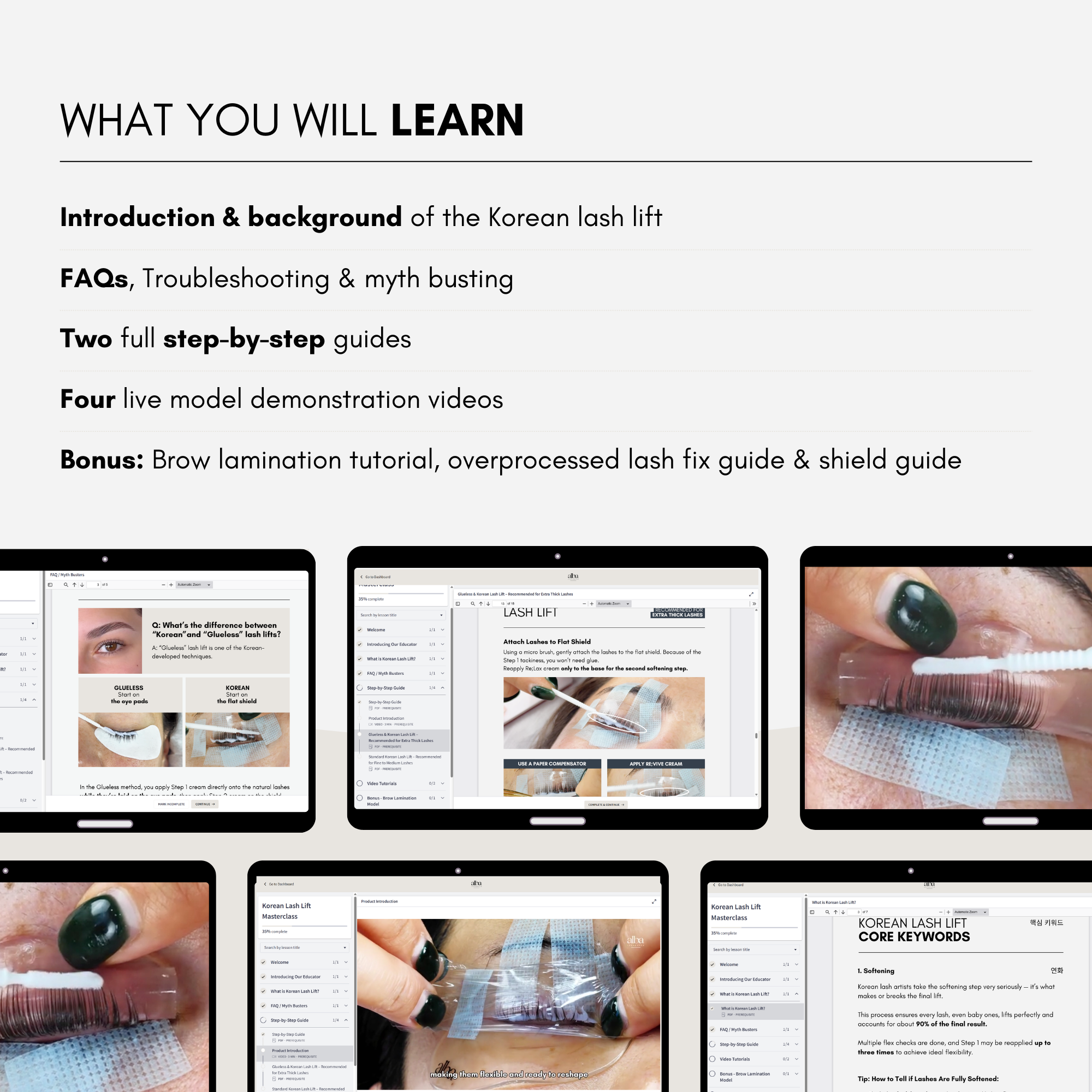

Education and Training: Expenses for courses, workshops, or certifications that enhance your lash application skills and safety knowledge.

Marketing and Advertising: Costs associated with business cards, websites, social media advertising, and other promotional materials.

Software Subscriptions: Any digital tools that support your business operations, like booking systems or client management software.

2. Keep Meticulous Records

It's vital to keep detailed records of all your business transactions. Hold onto receipts or invoices for everything you plan to claim. Going digital with these documents can simplify organisation and retrieval when tax time rolls around. Another tip to reduce headaches is to create a separate bank account to distinguish between personal expenses and business expenses.

3. Tips if You're Home-Based

If your business is based at home and meets local council regulations, you might be able to deduct a part of your household expenses, such as electricity, internet, and rent. Just make sure to only claim the portion that directly relates to your business use.

4. Plan for the Future

Remember, now that you’re your own boss, taxes aren’t automatically deducted from your earnings. Setting aside a bit of money for taxes regularly can ease the burden of a hefty tax bill later. This little habit can make your financial management much smoother.

EOFY is also the perfect time to invest in your business with some big purchases, thanks to plenty of sales. Why not treat yourself and your clients to upgraded equipment like lash lights, comfy mattress toppers, or ergonomic salon stools? These investments not only boost your service quality but are also deductible, helping to lower your taxable income.

Disclaimer: This article is just a general guide and not meant to replace professional tax advice. Since everyone's situation is different, we recommend talking to a qualified tax professional for tailored advice.